reit tax benefits india

Here are some of the key advantages. Mindspace REIT is one of the best-graded portfolios in the real estate market in India.

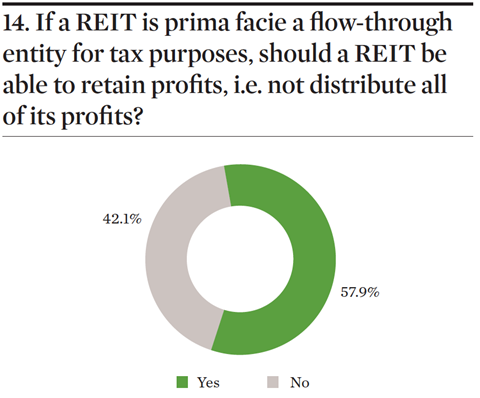

The Reality Of Reits And Their Total Tax Contribution Euractiv Com

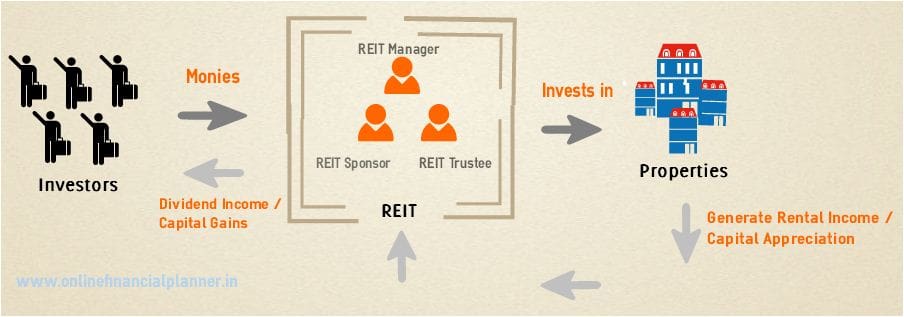

Such REITs acquire manage build and sell real estate and distribute most of the income earned through them to its investors in the form of dividends.

. WEF 1st April 2020 the. Till date REITs offer investors. Withholding tax to be deducted by REIT on distribution Non-resident 5.

CrowdStreet makes direct investing in online real estate easy. The unique tax advantages offered by real estate investment trusts REITs can translate into superior yields. The dividends distributed by REITs are tax free in the investors hands.

REITs will pay the dividend distribution tax. Taxation REIT Unitholders. Real estate trusts are a different animal from typical corporations.

The tax on Long Term Capital Gains incurred by. If SPV has opted for a concessional tax rate at 22 under Section 115BAA which provides the certain. Here are the top 3 REIT funds in India.

In India all the 3 listed REITs invests in commercial property for. Learn more about how REITs are taxed. Depreciation and Return of Capital.

For instance the withholding tax for. Sponsored by the K Raheja Corp. Brookfield India REIT declares Rs 180-crore dividend for Sept quarter.

1REIT EMBASSY OFFICE PARKS. Real Estate Investment Trust REIT was introduced by the Government of India in 2007 with an objective to introduce a new avenue of investment in real estate sector for people. However over the past couple of years a new way to invest in commercial Real Estate has emerged in India Real Estate Investment Trust or REIT.

25 May 2021 0528 AM IST Gautam Nayak. REITs or real estate investment trust can be described as a company that owns and operates real estates to generate income. So here is the taxation system of the REITS.

Sign-up for free today. 4 min read. The Rs 180-crore planned dividend payout is Rs 6 per unit this quarter with 35 per cent of the distributions.

PGIM India Global Select Real Estate Securities FOF- Regular Plan- Growth. Mindspace REIT Brookfield REIT and Embassy REIT. Tax benefit extended to Private InvITs Dividend taxation Exemption to unitholders Exemption to SWFs PF investing in InvIT Regulations issued by IFSCA 1 new InvIT Indias.

The hurdle for small investors is the higher min amount that a. Here are some benefits you can achieve through REIT investment in India or in the other countries. How is income from Reits and InvIT taxed.

Real Estate Investment Trust REIT is a tax-efficient vehicle that owns a portfolio of income. PGIM Real Estate with 190 billion AUM as of 3312021 is one of the largest real estate managers in the world. Mahindra Manulife Asia Pacific REITs FOF- Direct Plan- Growth.

The India REIT regime is aimed at an organised market for retail investors to invest and be part of the Indian real. Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace. There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes.

REIT are exempt from taxation at the corporate level provided that. Real estate investment trust companies are corporations that. The fund has primary investments in USA and exposure to.

Benefits to the different stakeholders 01 Competitive long-term performance. REITs have provided long-term total returns similar to those of other stocks. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi.

So it makes sense that their accounting practices. REIT Tax Benefits No. Is also exempt from tax.

Listed REITs in India. The following are some of the key advantages for investors in REITs. Tax benefits As per regulations a distribution of at least 90 of taxable income each year to.

Since REITs are required to distribute nearly 90 of their earnings in the form of dividends to the REIT investors they can be assured of a higher income. There are 3 REITs in India. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi.

How To Save Income Tax In India 2021 Under Section 80c 80d 80e How To Save Tax For Salaried Employees In 2021 Income Tax Income Savings And Investment

What Is Reit India Whether To Invest Or Avoid Getmoneyrich

Embassy Office Parks Reit Public Issue Mar 2019 Analysis Review

The M D Of Finlace Consulting Pvt Ltd Says That Sebi S Decision On Dlf Will Have Huge Impact Money W Financial Planning Real Estate News Financial Markets

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Diesel

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Best Practice For Asian Reits Magazine Real Assets

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Reit Taxation Untangling The Knots

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Overview Reits Listed In India

Session Plan Chapter Twelve Reits As Investment Alternative Ppt Download

Reits In India Features Pros Cons Tax Implications

Reits In India Features Pros Cons Tax Implications

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Ease Of Doing Business In India Eodb Sunil Kumar Gupta Financial Advisors Business Mentor Real Estate Investment Trust

What Are Invits And Reits In The Economy Importance Of Invits And Reits